Planning and Executing the IR Programme

Combine shareholder mapping, engagement tracking, and advisory support to target and retain the right investors.

3 products included

Products

The Investor Relations CRM that powers smarter targeting

Gain deeper insight into your shareholder base

Make your IR website the source of truth for investors

Navigate the capital markets with expert, actionable insights

Fuel your ESG efforts with expert insights

Power your investor relations, governance, compliance and corporate communication—all from a single secure, professional-grade portal.

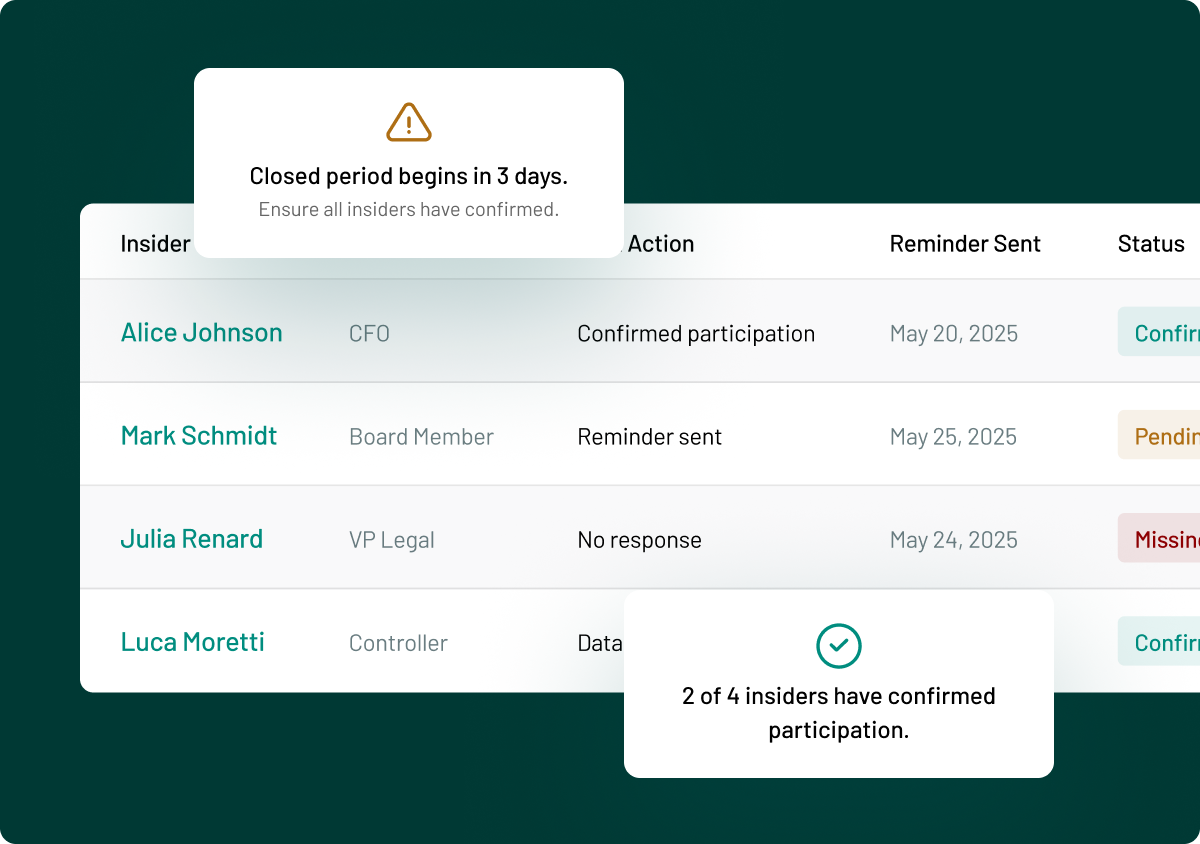

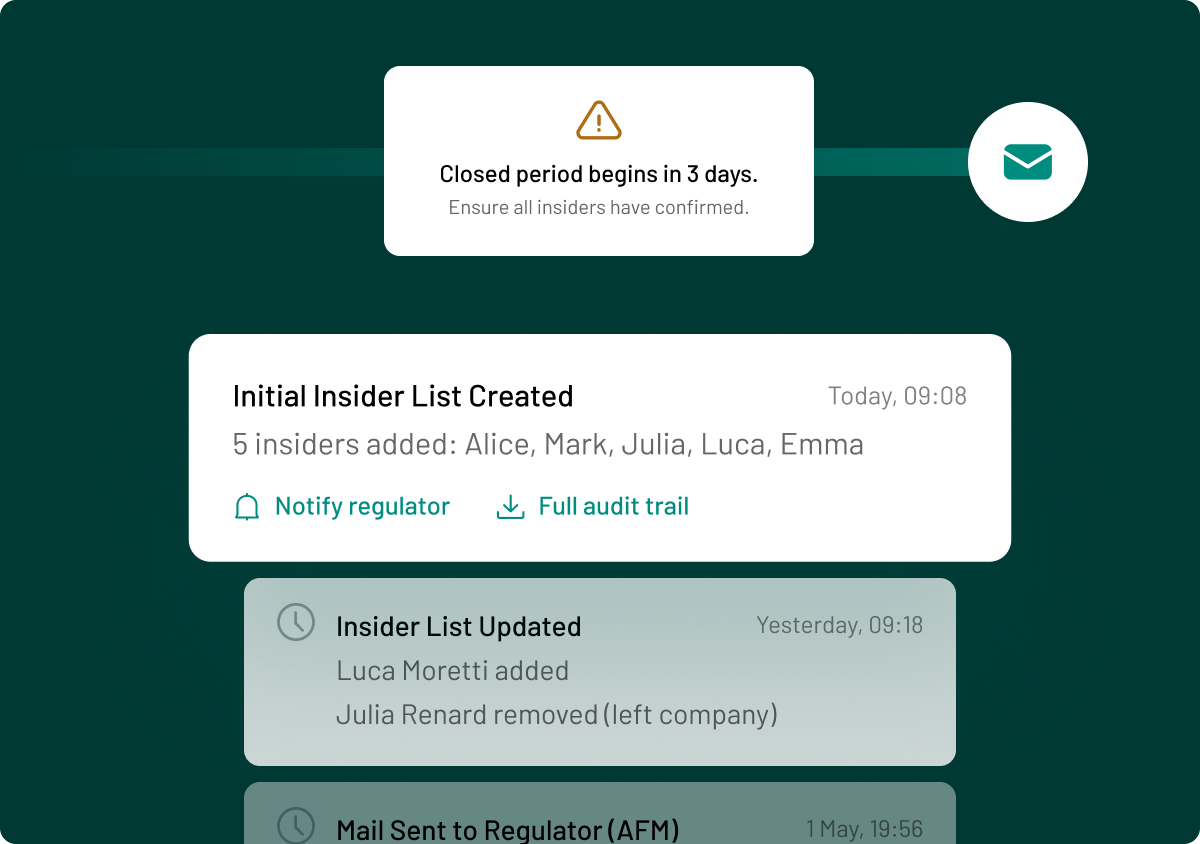

Simplify MAR insider list management

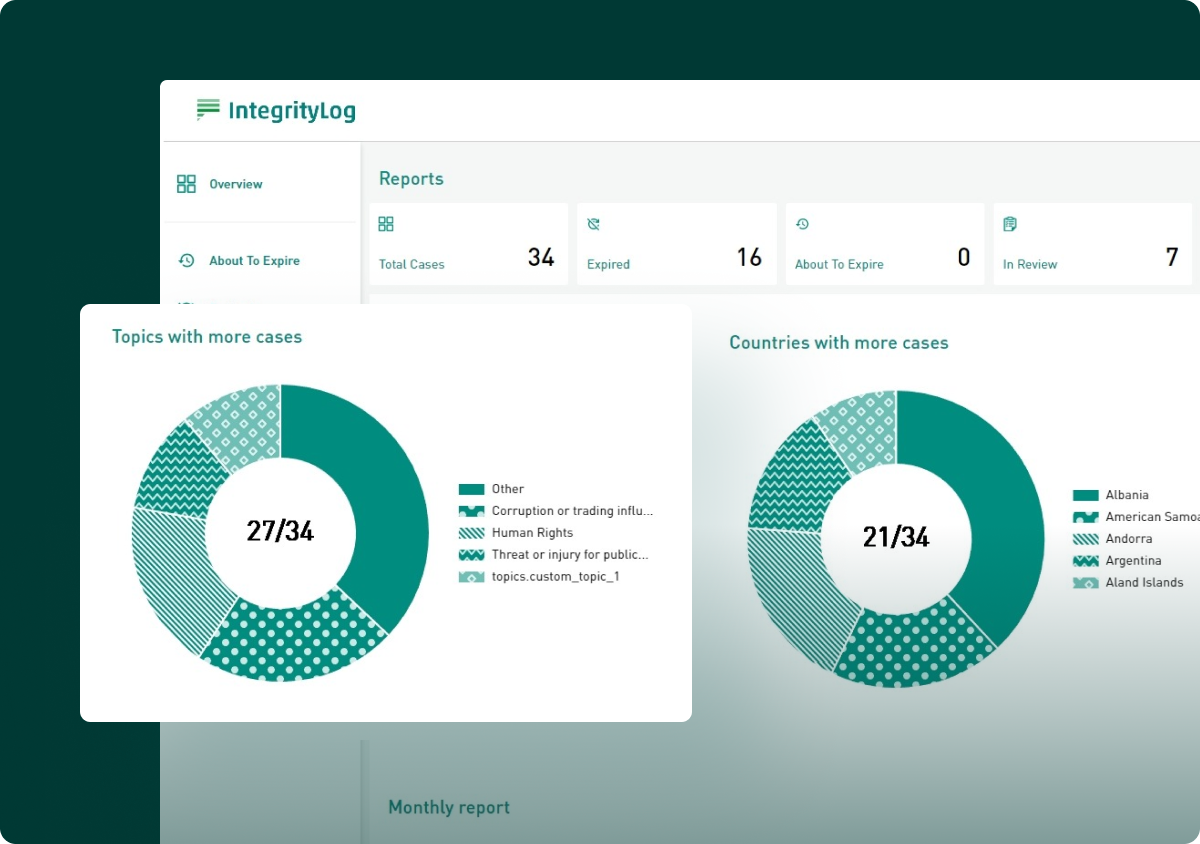

Secure, compliant whistleblowing software

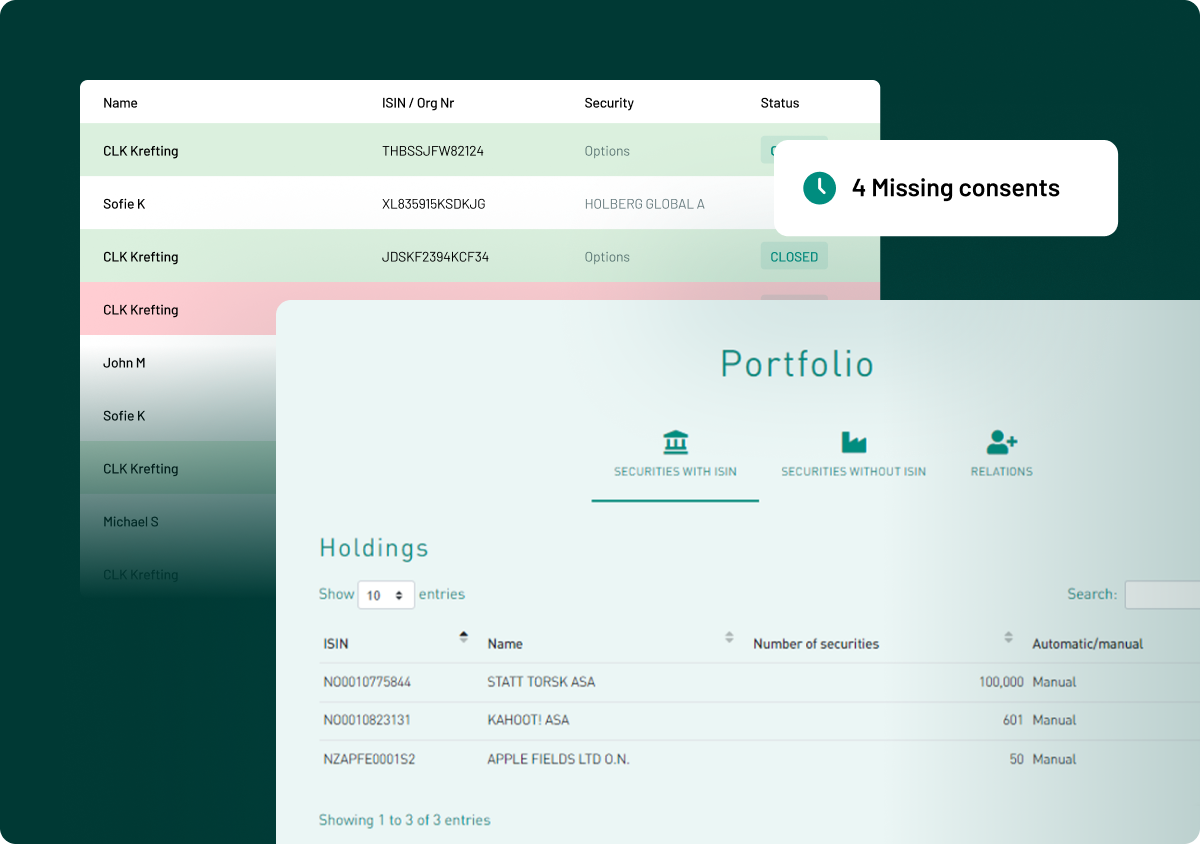

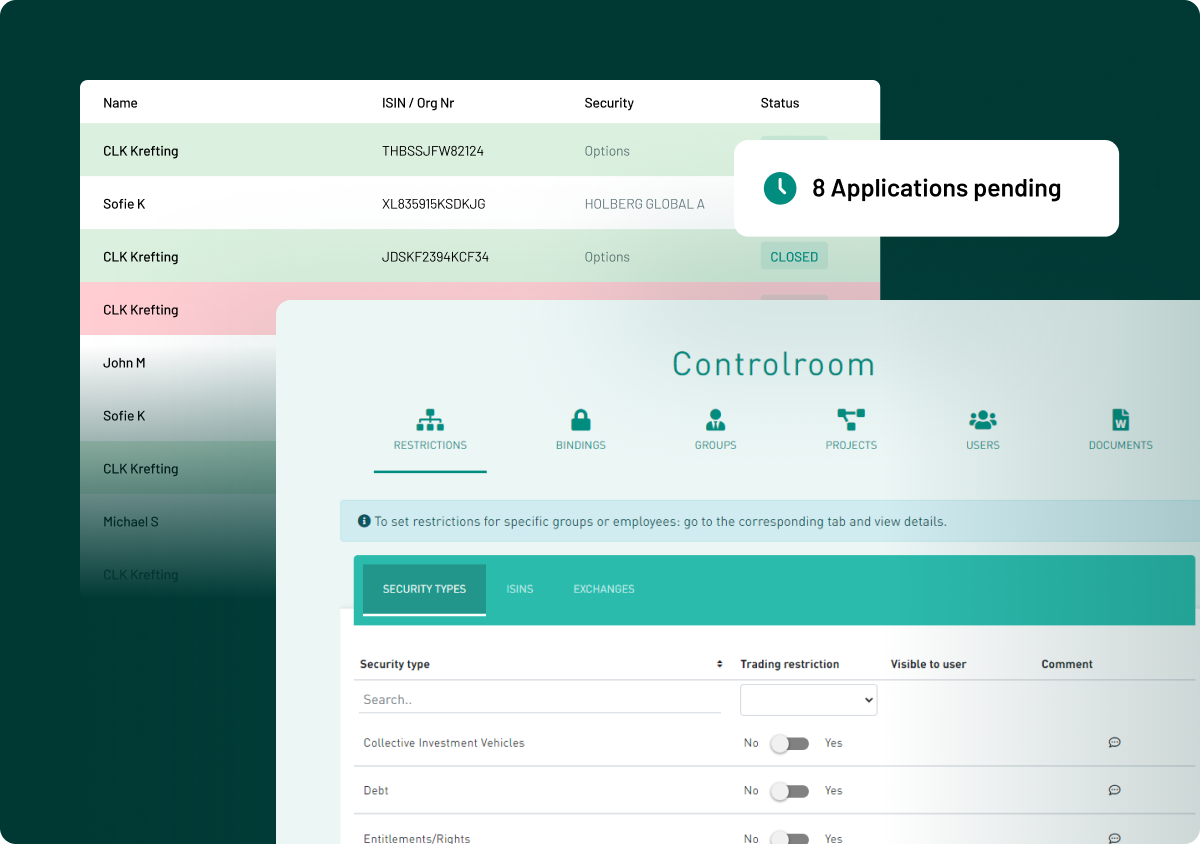

Prevent market abuse with employee personal trade monitoring

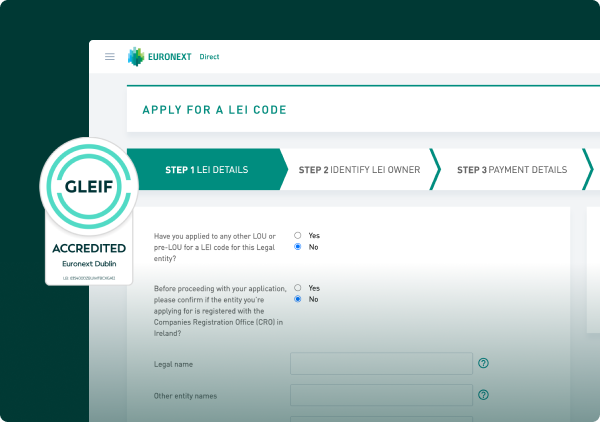

LEI Services helps financial market participants meet regulatory requirements with confidence across borders

Good governance made easy and secure

.png)

Gain a clear view of your board’s effectiveness with structured evaluations

.png)

Drive M&A deals efficiently with a purpose-built platform

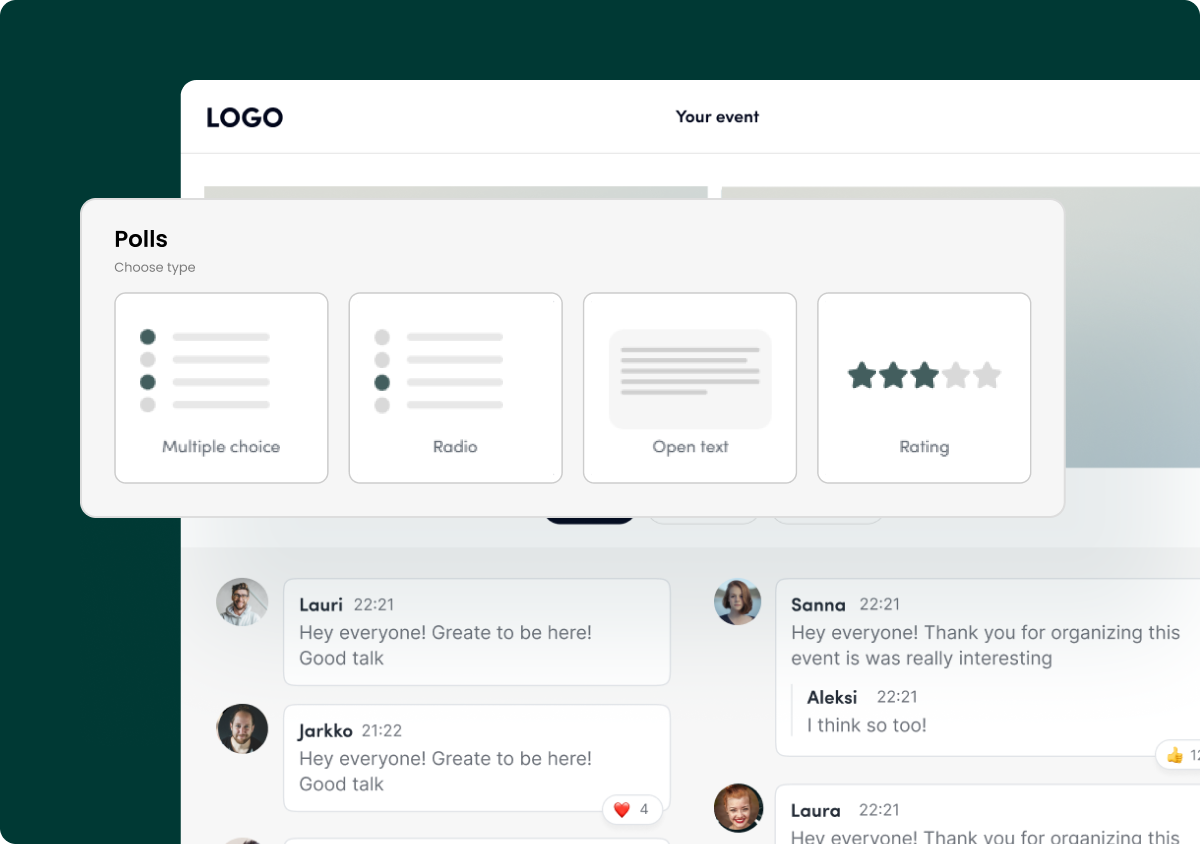

Deliver engaging investor relations and corporate events

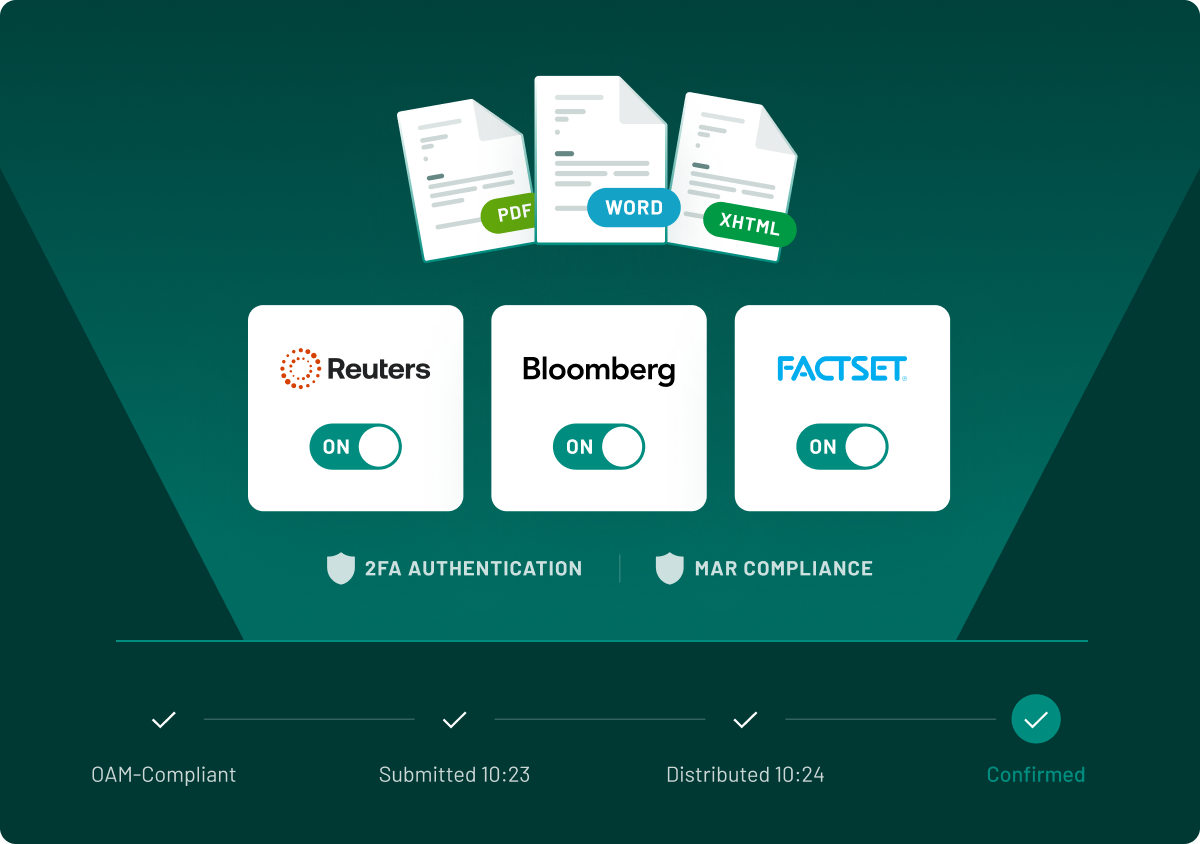

Ensure timely market disclosures

Host world-class events in an iconic Milan venue

Power your investor relations, governance, compliance and corporate communication—all from a single secure, professional-grade portal.

Power your investor relations, governance, compliance and corporate communication—all from a single secure, professional-grade portal.

Solutions

Capital Market Readiness & Successful Listing Journey

Turn investors into long-term partners

Simplify shareholder management. Understand and track ownership changes with ease. Enhance transparency.

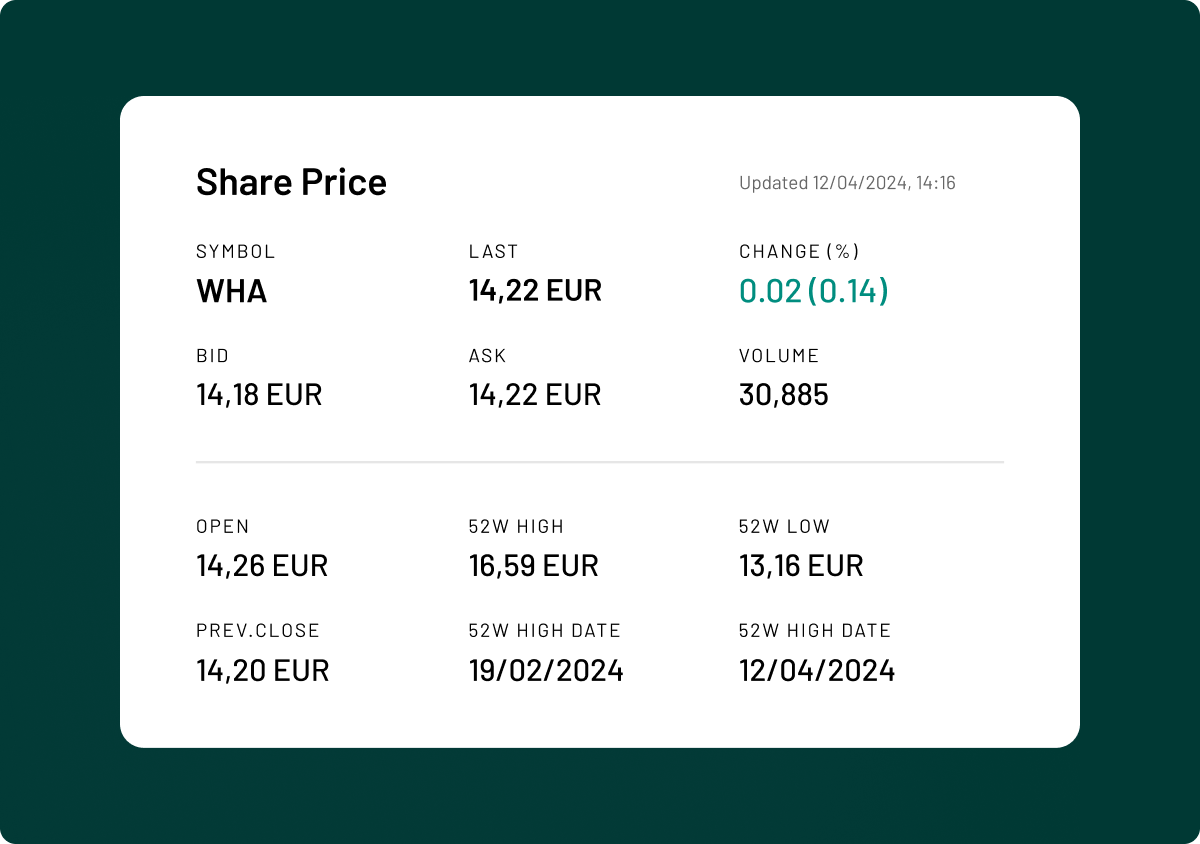

Engage investors with real time share prices & live stock feeds. Utilize an interactive share price dashboard to display accurate market data.

Leverage capital market insights and professional advisory services to navigate complex markets.

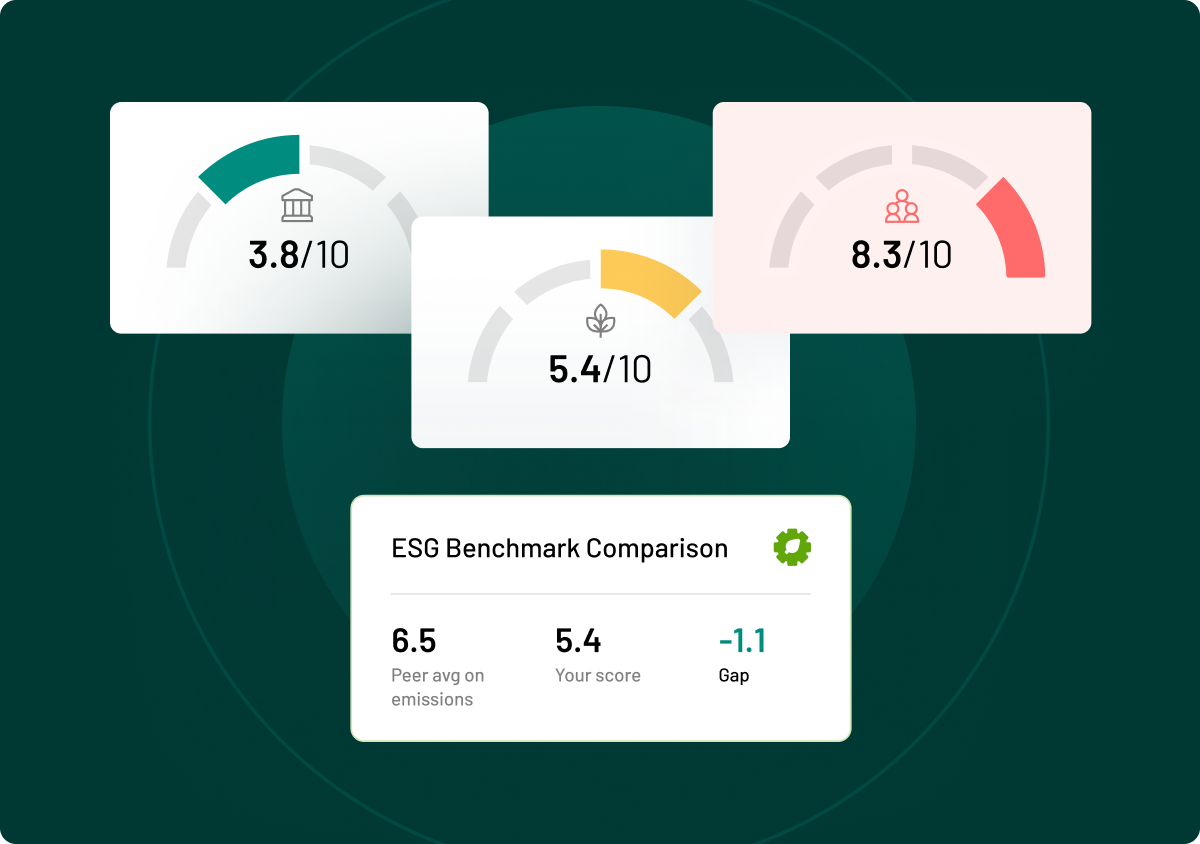

Improve investor trust, meet regulatory standards, and showcase your commitment to sustainability.

Strengthen your IR strategy with integrated tools that connect targeting, ownership analysis and strategic advice.

Lay the foundation for a successful market entry with a trusted suite designed to support compliance, transparency and stakeholder engagement at every stage of your IPO journey.

Reach the right investors and drive engagement with real-time data and insight-led outreach.

Stay visible and aligned with investor expectations as you mature on the public markets.

Deliver a compelling narrative at key investor events with data, targeting and messaging support.

Strengthen investor trust and communicate your ESG commitments with transparency-driven tools and advisory support that elevate corporate reputation and accountability.

Deliver accurate, compliant and compelling financial communications across all digital channels, while reinforcing investor confidence.

Our comprehensive platform provides the essential tools for investor relations, compliance, and governance.

Regulatory Compliance & Corporate Governance

Achieve MAR compliance with robust insider list management. Navigate EU Market Abuse Regulation requirements, reduce risks, & enhance corporate governance.

Enhance compliance with robust employee trade monitoring tools. Prevent insider trading, enforce trading policies, and maintain market integrity.

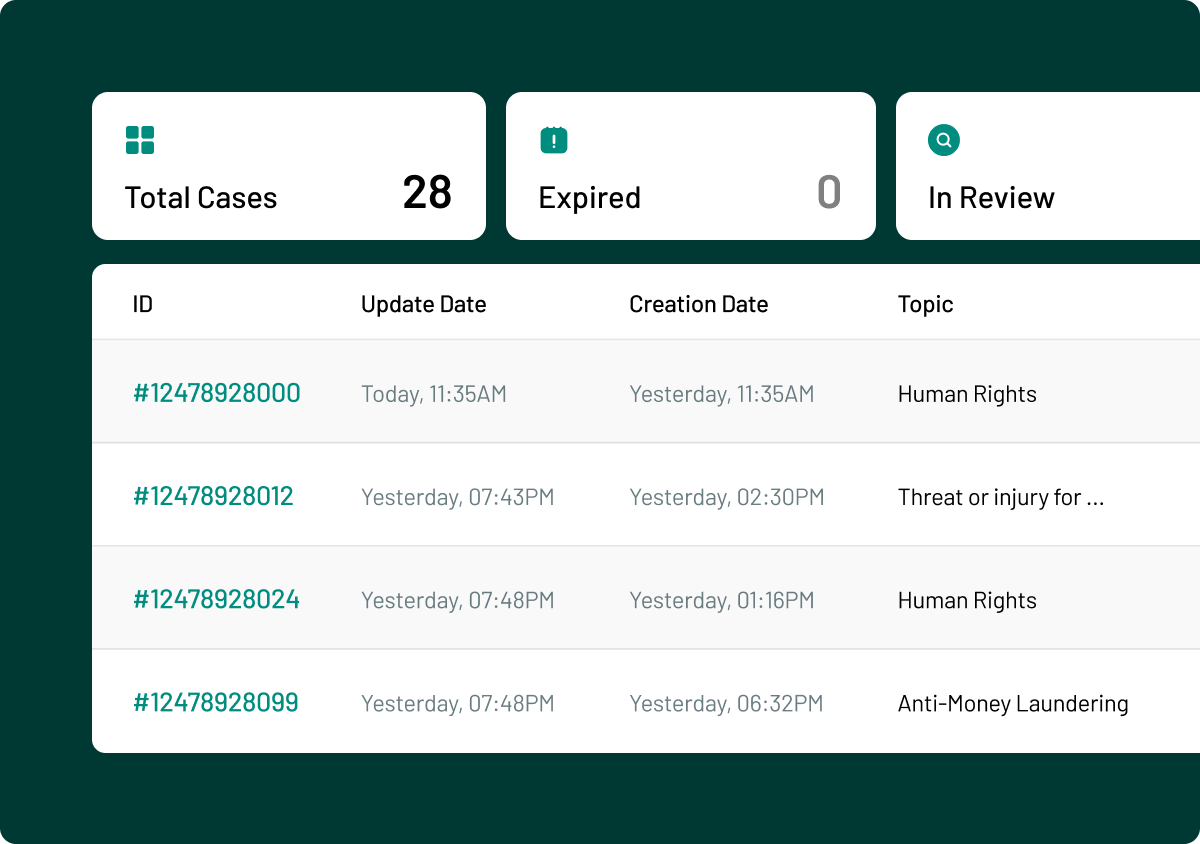

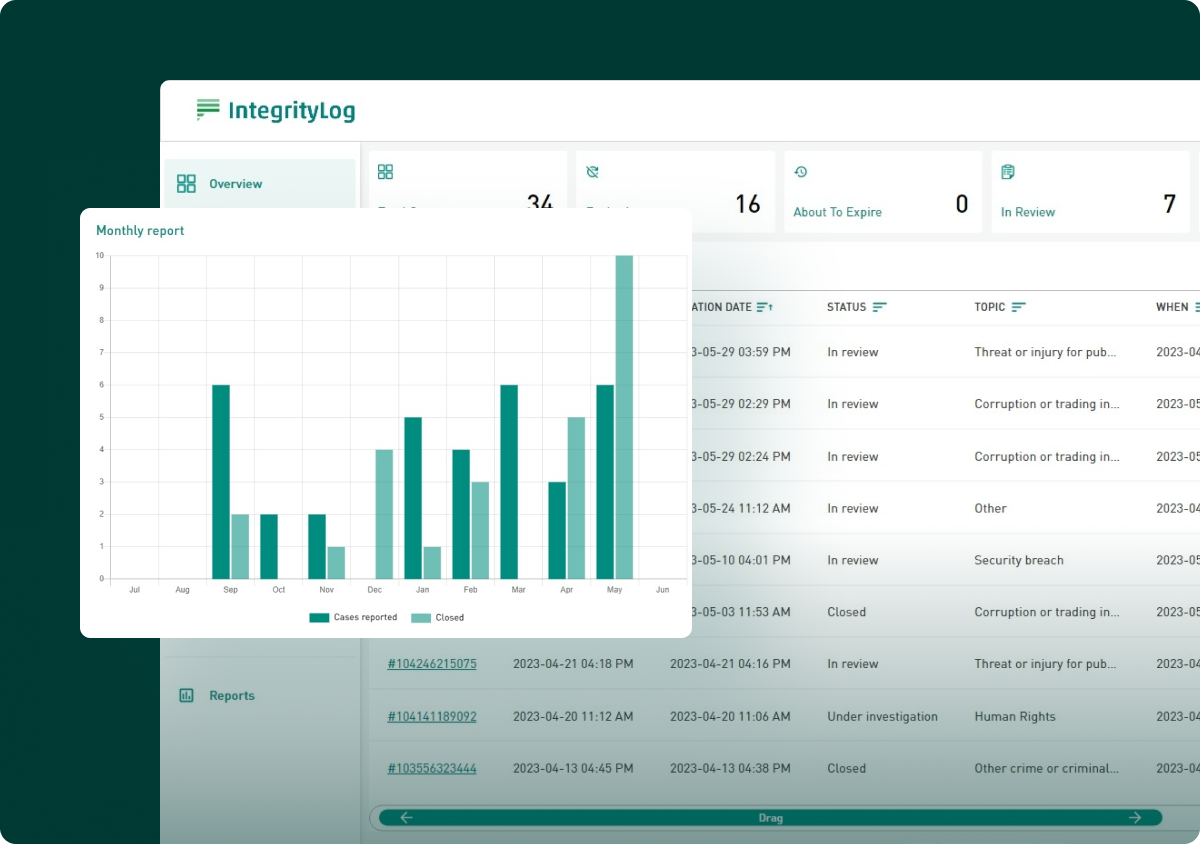

Ensure whistleblower protection with secure reporting channels. Utilize anonymous reporting tools, maintain confidentiality, and meet compliance standards.

.png)

Manage your LEI compliance efficiently with our LEI solutions. Conduct accurate LEI code lookups and meet international standards.

.png)

Optimise your board meetings with secure & efficient board meeting software.

Simplify regulatory disclosures, strengthen governance, and support a transparent disclosure strategy.

Achieve full MAR compliance with a complete solution suite covering insider list management, employee personal trading processes and market disclosures.

Deliver full compliance coverage from your internal ethical culture to external regulatory obligations with an integrated compliance suite.

Support robust board governance and ethical conduct with integrated tools for secure collaboration, transparency and accountability.

Ensure compliance across borders with integrated solutions that meet regulatory demands in multiple jurisdictions.

Empower executive teams and board members with secure, collaborative tools that enhance governance, oversight and ethical leadership.

Everything you need to manage complex transactions with confidence.

Our comprehensive platform provides the essential tools for investor relations, compliance, and governance.

Corporate Communications

Protect your reputation and ensure regulatory alignment with secure, responsive solutions designed for times of heightened scrutiny.

Protect your brand with advanced reputation management and crisis response tools.

Enhance corporate messaging with trusted delivery, sustainability alignment and secure governance tools.

Strengthen boardroom governance with secure digital tools for collaboration and compliance.

Our comprehensive platform provides the essential tools for investor relations, compliance, and governance.

Learning & Upskilling in Capital Markets

Enhance decision-making, understand market trends, and drive strategic growth.

Advance your career with expert-led compliance courses & certification programs.

Strengthen internal IR capabilities and sustainability knowledge with expert-led learning and tailored support.

Build expertise with bespoke compliance training and governance courses.

Our comprehensive platform provides the essential tools for investor relations, compliance, and governance.

Resources

Academy

Browse our IR, Compliance and Governance professional development courses and certifications

.webp)

Develop the exact skills your team needs to succeed in capital markets

Stay ahead with widely recognised certifications

Build trust through expert IR communication

Navigate today's complex regulatory environment with confidence

Learn sustainability strategy from ESG experts

Dedicated training for compliance officers and employees of issuers

Help your employees understand their obligations and potential sanctions

Our comprehensive platform provides the essential tools for investor relations, compliance, and governance.

Resource Centre

Answer a few short questions to assess the relevance of your sustainable reporting format, ensure you have the right audience, and compare your ESG disclosure policy with the expectations of investors and ratings agencies.

Blogs and News

Power your investor relations, governance, compliance and corporate communication—all from a single secure, professional-grade portal.

Events

Our comprehensive platform provides the essential tools for investor relations, compliance, and governance.

Glossary

Enrich your compliance vocabulary and gain a deeper understanding of regulatory compliance terminology.

Our comprehensive platform provides the essential tools for investor relations, compliance, and governance.

Post-Listing Advisory is a strategic advisory service to help listed companies craft an engaging equity story and foster trust with the investment community.

Trusted capital markets advisory supporting issuers across Europe

Deliver impactful presentations, sharpen your messaging and confidently engage with the right investors.

Plan and execute your Annual General Meeting with precision, ensuring compliance, clarity and strong shareholder engagement.

Communicate your financial performance with transparency through expertly crafted reporting and analyst-ready materials.

Clearly communicate your strategic direction, reinforce your equity story and deepen investor confidence.

Position your company clearly in the capital markets with a narrative that builds trust and attracts long-term investors.

Receive end-to-end advisory to engage with your shareholder base more effectively and align your IR activities with strategic objectives.

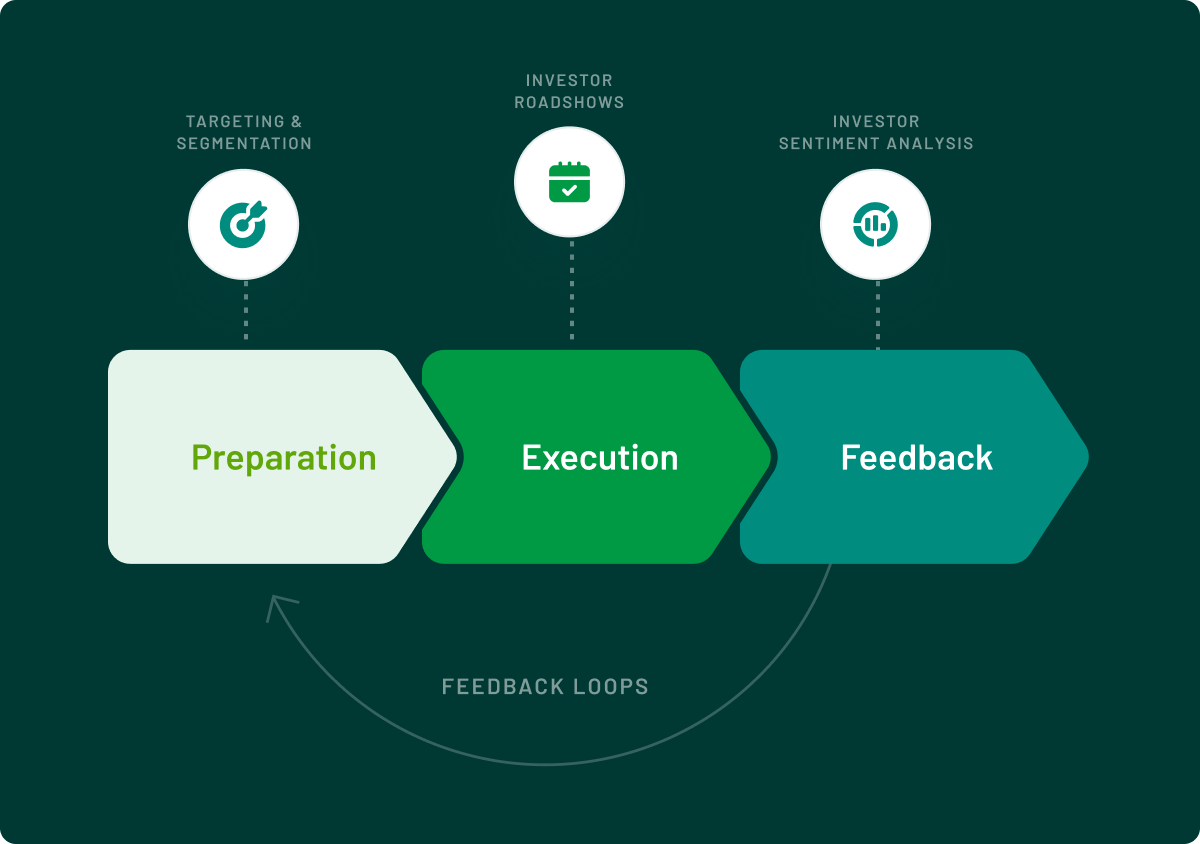

Maximise your listing lifecycle with data-driven insight and strategic guidance at every stage of your investor relations calendar.

Identify and reach investors most likely to align with your company’s vision and strategy.

Gain deep insight into how the market sees your company through direct feedback from analysts and institutional investors.

Monitor trading activity, investor behaviour and peer developments to stay ahead of shifts in sentiment.

Craft a strategic, actionable investor relations plan tailored to your capital markets objectives.

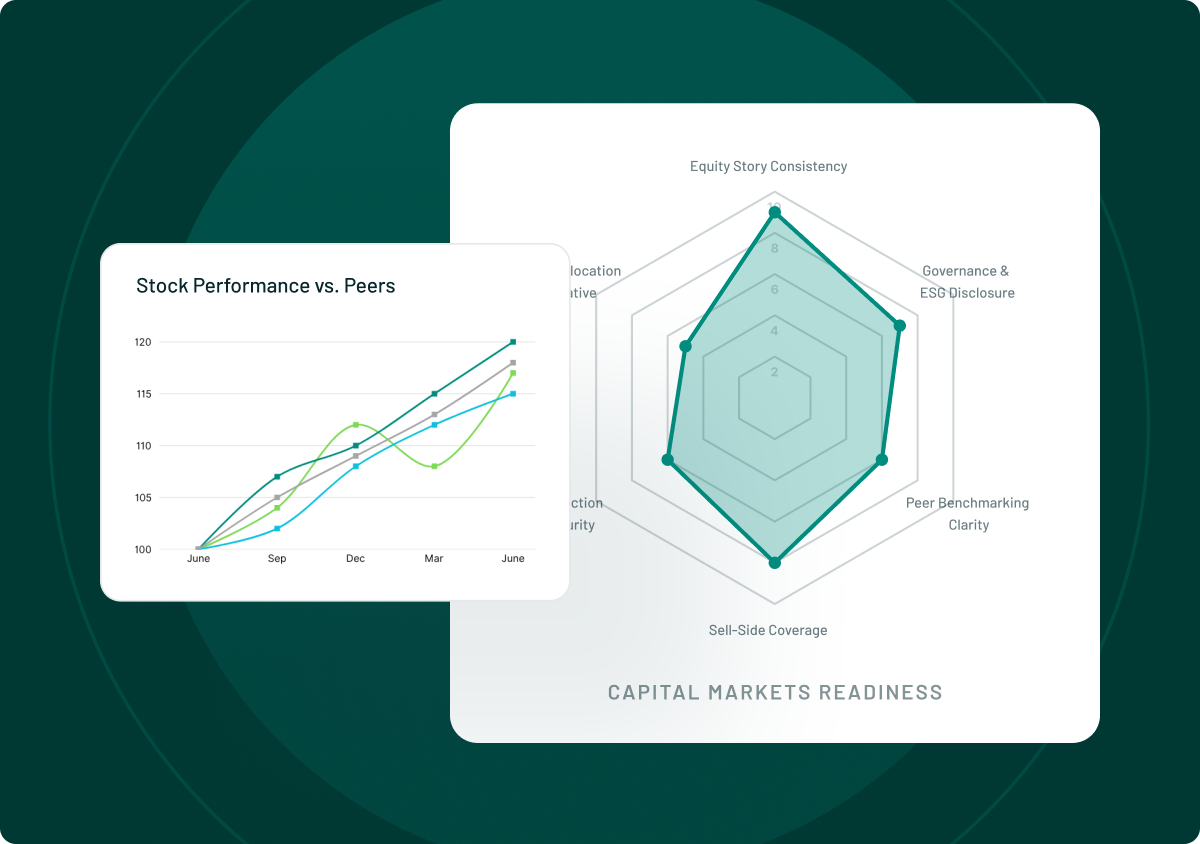

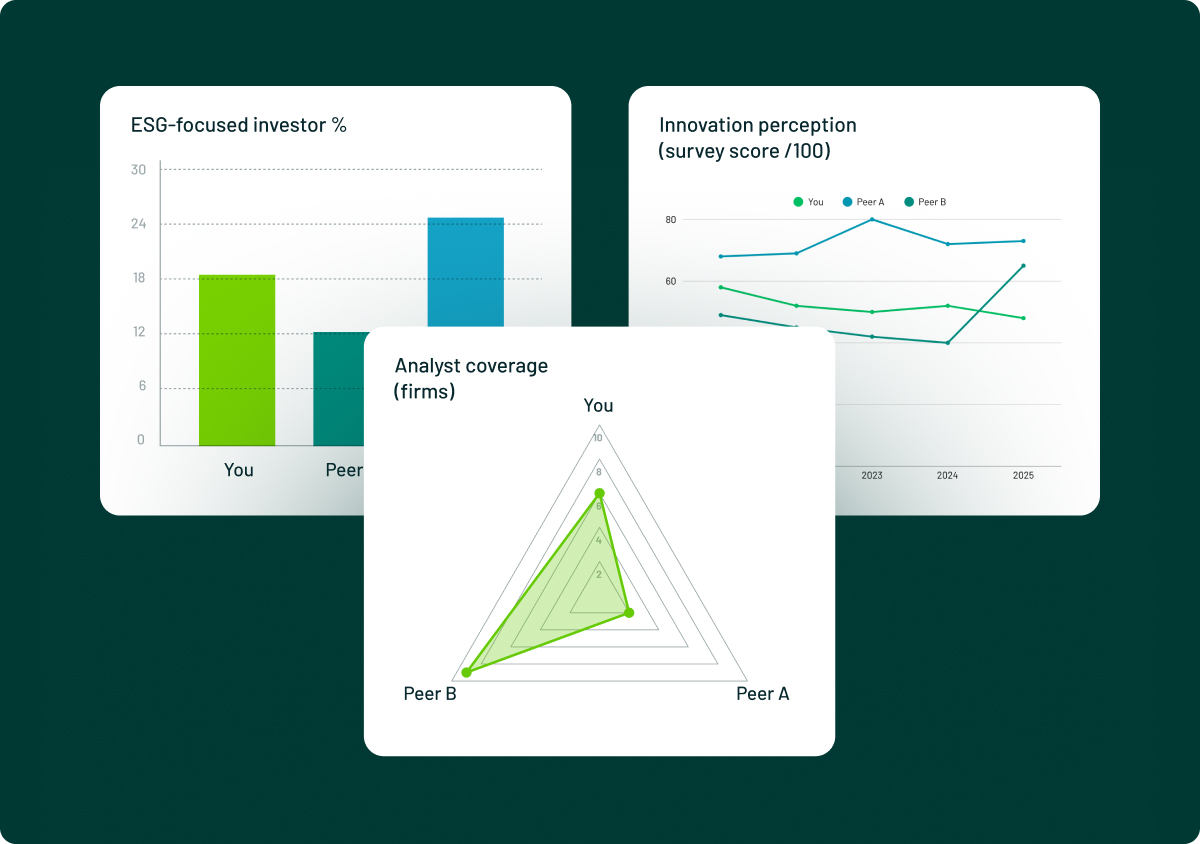

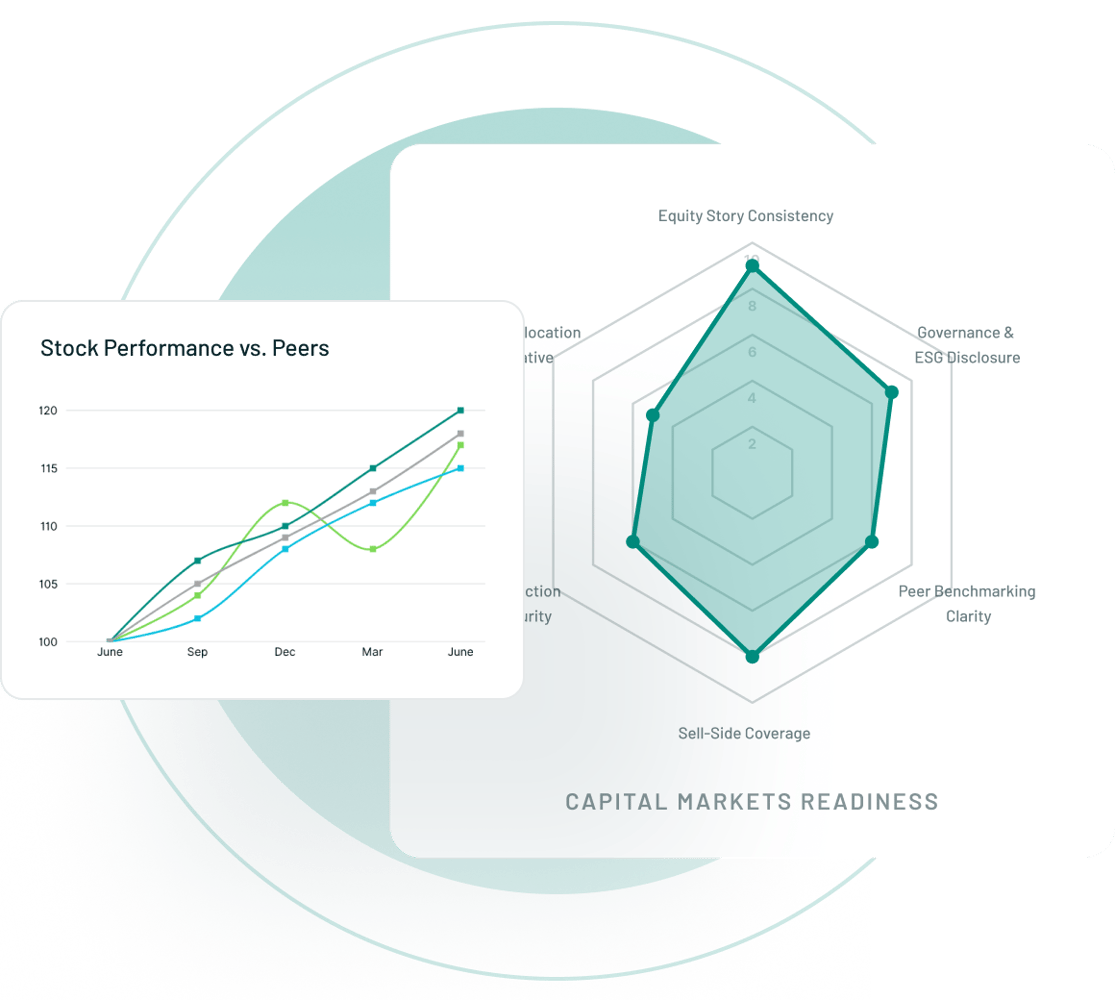

Euronext’s proprietary market intelligence transforms raw data into actionable insight. By combining trading activity, historical performance trends and trusted third-party research, we give you a clear view of how your company is perceived and how the market behaves. Whether you are refining your equity story, preparing board reports or targeting new investors, our data empowers you to act with confidence and clarity.

Track stock performance

Access a detailed history of your share price to evaluate trends and highlight milestones.

Monitor trading volumes

Understand investor activity and market liquidity through historical trade volume data.

Analyse investor behaviour

Identify behavioural patterns across your shareholder base.

Incorporate expert research

Complement proprietary insights with analyst ratings and independent investment research from trusted data partners.

Our dedicated advisors work as an extension of your internal function, embedding strategic support across your organisation from investor relations to the C-suite. We partner with you at every stage of your IR lifecycle, from shaping strategy and refining your equity story to preparing reports and engaging with shareholders. This hands-on model gives you access to expert-level capabilities without the overhead of an in-house team.

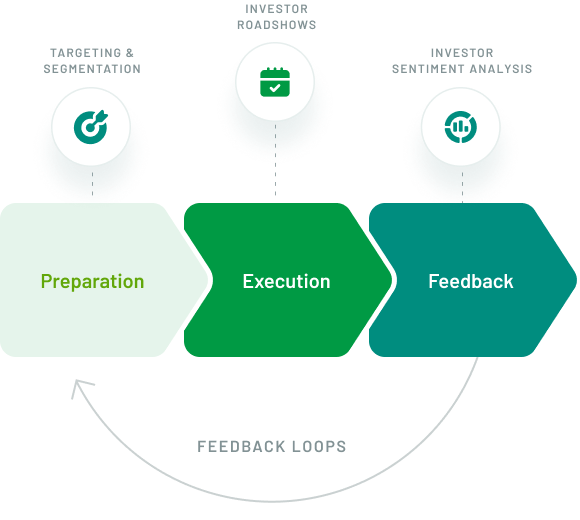

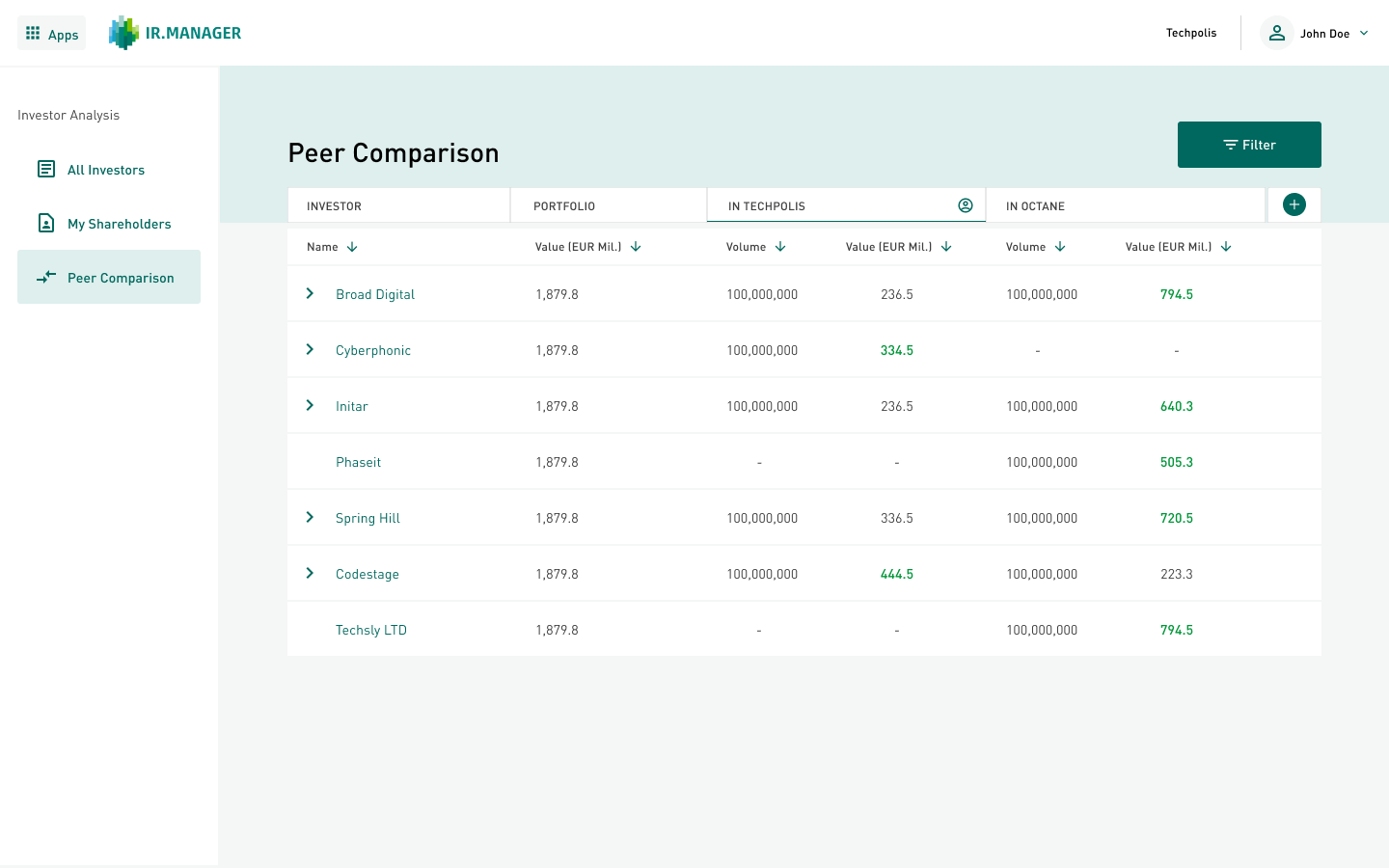

We begin with a comprehensive 360° view of your listing performance, including your shareholder structure, market perception, peer comparison and valuation.

Based on our market perception insights with analysts and portfolio managers, we create a tailored IR roadmap that includes equity story refinement, investor targeting strategy and communication priorities.

Throughout the year, you receive ongoing advisory support for all major milestones and communication moments. We provide feedback, benchmarking and strategic input for your IR activities, ensuring continuous alignment with market expectations.

Combine shareholder mapping, engagement tracking, and advisory support to target and retain the right investors.

3 products included

Ensure your message continues to resonate with the market through data, outreach and events.

5 products included

Plan and execute major capital markets events with precision and confidence.

4 products included

Understand your current and potential investors with data-driven Shareholder Analysis. Use these insights to support targeting and roadshow planning.

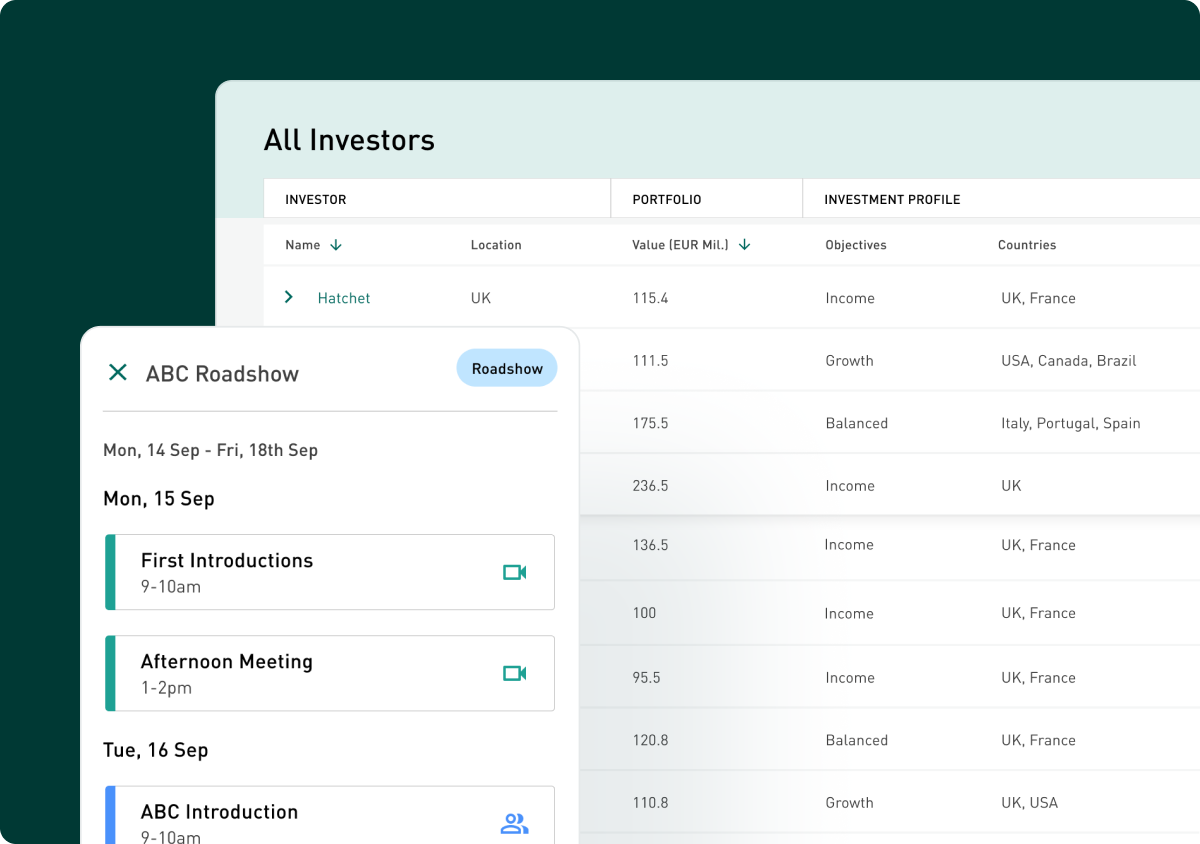

IR.Manager enables investor relations teams to organise meetings, track communications and target outreach around earnings events.

Post-Listing Advisory supports newly listed and mature companies with strategic IR planning, market intelligence and investor targeting services to build long-term capital markets success.

IR.Manager enables investor relations teams to organise meetings, track communications and target outreach around earnings events.

Euronext’s ESG Advisory helps companies build a credible sustainability strategy aligned with EU regulations and investor expectations.

Post-Listing Advisory supports newly listed and mature companies with strategic IR planning, market intelligence and investor targeting services to build long-term capital markets success.

Understand your current and potential investors with data-driven Shareholder Analysis. Use these insights to support targeting and roadshow planning.

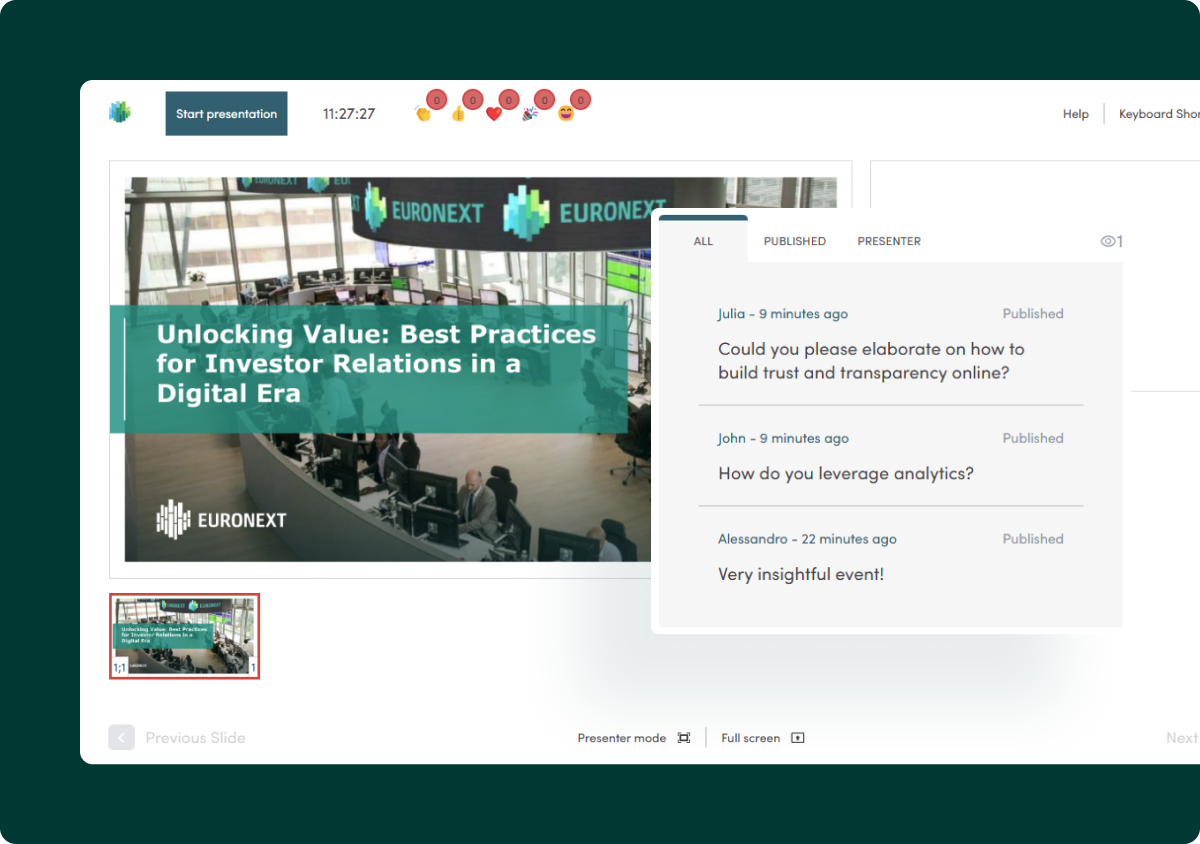

EngageStream enables you to present earnings, half-year results and key disclosures through a secure, branded event platform with interactive features.

Understand your current and potential investors with data-driven Shareholder Analysis. Use these insights to support targeting and roadshow planning.

IR.Manager enables investor relations teams to organise meetings, track communications and target outreach around earnings events.

EngageStream enables you to present earnings, half-year results and key disclosures through a secure, branded event platform with interactive features.

Post-Listing Advisory supports newly listed and mature companies with strategic IR planning, market intelligence and investor targeting services to build long-term capital markets success.

Fill out the form to get in touch with our sales team

Contact Sales

Learn more about the cutting-edge solutions and tailor-made advisory services that will help your company drive growth, ensure good governance and maintain compliance.

Fill out the form to get in touch with our sales team.

Euronext’s Post Listing Advisory service supports companies following their initial public offering (IPO), providing access to strategic investor relations advice and market intelligence. Our aim is to help listed businesses maximise the benefits of their market presence and strengthen engagement with investors.

Our advisory services include equity story development, investor targeting, perception analysis and reporting designed for board-level use. We assist companies in building an effective investor relations strategy that aligns with market expectations and supports ongoing capital markets activity.

We offer guidance to help optimise your market positioning and ensure adherence to regulatory requirements. This includes structured diagnostics of your listing performance, benchmarking and insights into shareholder structure and market perception to support informed decision-making.

You will have a dedicated Advisory Analyst as your primary contact. They will work closely with you to understand your business objectives and deliver tailored support throughout your post-listing journey.

By choosing Euronext, you gain access to a team with deep expertise in European capital markets, supported by proprietary market intelligence. We offer a comprehensive, strategic approach to investor relations that helps companies thrive beyond their listing.

Euronext has long-standing engagement with the biotech and pharmaceutical sectors, including initiatives such as the Biotech Leaders Conference and targeted market research. We understand the specific investor relations needs of these issuers and offer advisory services to support their growth and visibility on the capital markets.